The WTF project mgt and team collaboration problem

Today, complex products = complex organisations

Bob Story

Bob, a Marketing manager in a car company who is working on a new car concept project team. Bob needs to prepare a marketing launch for the Paris auto show planned in October 2018. Leading the marketing initiatives, he is doing different activities (plan/define tasks/tracking). Each team peer Bob interacts with has a different way of working (the hardware teams are in waterfall, the software team in Scrum, the digital team in Kanban and plant manufacturing in Lean six sigma). Each team and its members use different tools/apps (CAD, Trello, MS Project, Jira, SAP…) from various devices (IoT, mobiles, PCs…) generating different documents, files or transactions that create tremendous data.

What looks on the surface simple is not. Bob has to deal with 57 different interfaces!!! Just for a one-shot marketing launch…

Academic researchers have shown a high correlation between product complexity and organisation (Sosa et al, 2004). Well, the bad news is complex products will get more complex (i.e. today 10% cars value is software based, in 2030, it will be 30% according to McKinsey Global Inst, source: https://bit.ly/2HgJ0QK) which is creating even more “complicatedness” (according to Yves Morieux from to TheBostonConsultingGroup, source:https://on.bcg.com/2JPzLs6). Watch tedtalk here

Organisation creates “complicatedness” by multiplying layers, interfaces and interdependencies. Productivity plummets. Organisations increase project failure risk exponentially.

Bob has a real difficulty to execute the project. He does not give up. However, he is spending much time in coordinating and reporting. TheBostonConsultingGroup estimates managers spend up to 70% in coordination meetings and reporting, leaving only 30% for added value tasks (source: https://on.bcg.com/2J5J3yX).

Bob is courageous but feels he is not working on added value activities and begin to disengage.

Bob is not alone, there are 800 million knowledge workers like him (according to Forrester research), meeting and writing reports instead of DOING the work. Just imagine the waste in the scale of industries output or countries GDP.

800 Million knowledge workers like Bob are struggling

Emergence of organisations 2.0

Only 12% Fortune 500 firms in 1955 exist today (according to Forbes). Firms face faster and more brutal technological and market changes that create higher uncertainties. These forces push organisations to be more reactive, responsive or ambidextrous. However, this is not happening or with tremendous sacrifices because firms are still organised as a rigid structure living in highly predictable environments.

Alike the agile manifesto, newly created community #ResponsiseOrg urge to give up the old “command and control” for a new “responsive” organisation, (source: http://www.responsive.org/manifesto/)

Massive problem = big bu$ine$$

This massive problem is also a big business. The project and collaborative management software spending is estimated $21,4 Bn in 2017, growing 7,3% CAGR 13–18 according to IDC (IDC, 2018)

Not surprisingly, a lot of companies like Asana, Atlassian, Microsoft, and PLM vendors like Dassault Systèmes are trying to tackle the problem. Asana co-founder Justin Rosenstein explains how the company is positioning as firms “backbone”.

Organisations must better collaborate and work in a more efficient way to gain productivity. I do believe there are huge opportunities to disrupt the project and collaborative software industry like Airtable or Station, the 2017 product hunt winner based in Paris. The recent acquisition of Github, the developer collaboration platform by Microsoft is just the beginning.

The $5 billion dollars market tech players are missing

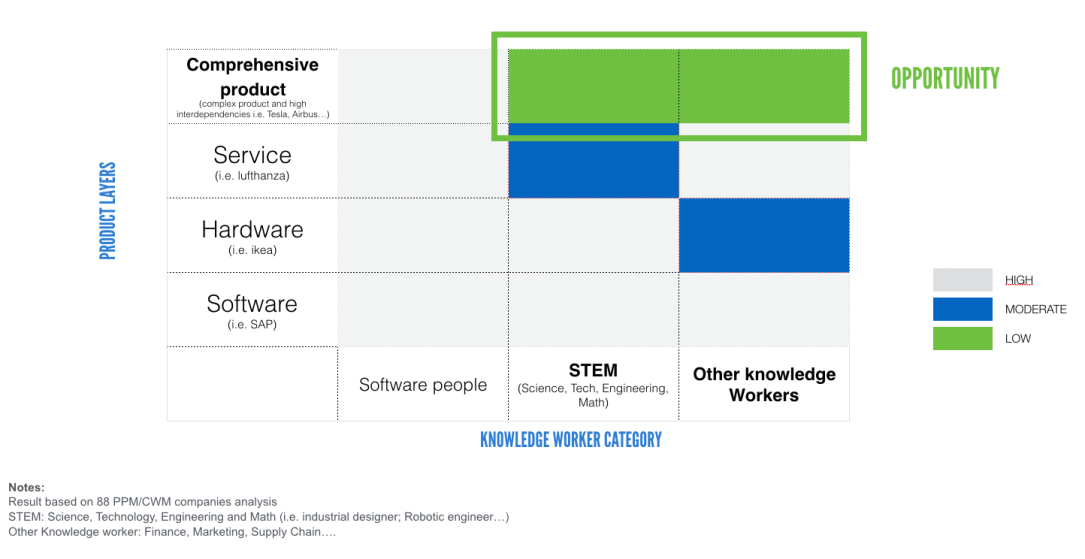

There are a massive team project and collaboration issues, defying today’s organisation rigid norms. Tech firms can help firms morphing into a more fluid organisation. I believe, however, software vendors and startups have only addressed primarily knowledge workers in services and support activities function (marketing, finance, HR etc..), software and design. Hence missing huge untapped market worth $5bn (CIMdata and IDC, 2018)

Based on 80+ project and collaborative tech firms market analysis(i.e. Asana, Atlassian, Smartsheet, Autodesk…), we can claim the knowledge workers involved in complex product teams in discrete industries are unaddressed today.

Knowledge workers involve in complex product teams in discrete industries are unaddressed today.

Through complex product I mean multi-disciplinary teams working for a new product development project. By discrete industries I mean automotive, aerospace, high tech, industrial equipment. For example Uber or Tesla Motors self-driving cars, Airbus air taxi project teams. There, hardware prototypes, manufacturing plant managers, software developers, mechanical engineers, data scientist, finance, legal, sales, design and product management people collaborate together. In this scenario, as shown above with Bob’s story, team peers inter-dependance, interfaces and data generated are incredibly complex to manage and exponential.

Industries are transforming. Industry 4.0 movement, millennials and post millennials entering in force the labour market with new aspirations and purposes, tech (AI, the blockchain, social messaging…) and market rapid and brutal turbulences, I do believe a change dynamic is underway.

Enabling that transformation will need a new type of project and collaboration management paradigm. The open question is, who will enable Bob?